The AI-Powered Financial Stack

What must be built before autonomous capital goes mainstream

What does real, agent-driven finance require that demos and APIs don’t show? At the DeFAI Breakfast panel “The AI-Powered Financial Stack”, participants from projects working on agent orchestration, trading and swaps, and L1 automation discussed the concrete engineering, trust, and product pieces that are still missing.

This recap focuses on the technical gaps and practical steps the panel identified: how agents move from “assist” → “propose” → “execute”; what guardrails are needed; how reputation, staking and automated evaluation must work; and where UX and orchestration have to improve for mass adoption.

Panel: Ron Bodkin (Theoriq), Amy Boudreau (0x), Julia Mihailescu (Agoric), moderated by Geng Kai (DFG).

🎟 50 Free Invite Tickets for dAGI Summit

Interest in dAGI Summit has been overwhelming, and we know not everyone has the resources to join. Thanks to our sponsors: Giza, Phala Network, NEAR, Bhindi, Truenorth and others, we’re opening an invite list for 50 free tickets.

Tell us about yourself and your work, and get a chance to attend one of the most important AI gatherings of the year.

📅 October 24 • 📍 San Francisco • Open Source AI Week

The autonomy continuum: assist → recommend → full autonomy

Agents in finance are not binary. The practical lifecycle seen in deployments:

Assist / in-the-loop: agent proposes transactions, presents options, and waits for human confirmation.

Semi-autonomous: agent recommends and can execute under pre-set guardrails (e.g., daily limits, slippage caps). Smart contracts enforce those constraints.

Fully autonomous: agent acts continuously, rebalancing or migrating positions as markets change.

Architecturally this implies two things: (1) on-chain guardrails (vaults / smart contracts that limit an agent’s authority), and (2) modular agent swarms where multiple specialized agents handle sensing, decision, and execution.

Orchestration layer = programmable capital + seamless UX

Panelists emphasized that the product problem is orchestration: translating intent into multi-step, cross-chain actions reliably.

Seamless orchestration means a single flow that can bridge chains, compose swaps, and reallocate positions under one signature while the agent coordinates the steps.

The UX focus is critical: users expect the convenience of Web2 flows without losing control. That requires clear parameterization (risk profile, approval rules) and transparent rollback/exit paths.

Practical result: builders should design composable primitives (bridge, DEX swap, protocol deposit) exposed to agents via deterministic interfaces.

Data and evaluation: reputation > compute verification

Verifying compute alone is not sufficient to trust outcomes. Key signals for trust:

Track record: reproducible performance history and independent evaluations matter more than a model’s provenance.

Automated evaluations: continuous, domain-specific testing and benchmarks that measure behavior over time (not just static metrics).

Reputation + staking: agents should carry economic skin-in-the-game; stake/slash mechanisms align incentives and provide remediation paths for malicious or faulty behavior.

Consequence: teams must instrument agents to emit auditable traces, enable continuous benchmarking, and publish verifiable performance data.

Tokenization: utility, capital formation and hype risk

Tokenizing agents have tradeoffs discussed in detail:

Pros: token gating and token-based capital formation can fund agent development and align economic incentives for early contributors.

Cons: tokenization can invite speculation and “pump-and-dump” behavior if utility and metrics are not established. Token gating without track record amplifies trust problems.

Pragmatic path: prioritize measurable utility and reputation before broad tokenization. If tokens are used, pair them with transparent metrics and mechanisms (e.g., stake + vesting + performance gates).

Security, jailbreaks, and exploit discovery, governance must follow capability

Agents are already capable of discovering vulnerabilities; that capability has dual uses.

Agents can find zero-days and novel exploits — useful for automated auditing but dangerous if misused.

Jailbreaking remains easy on today’s models; users can coerce agents into bypassing guardrails unless defenses exist.

Governance toolbox proposed: on-chain accountability (slashing), compliance guardrails, ethical rules encoded in agents, and “AI cops” — evaluator agents that monitor and flag malicious behavior.

Design principle: treat high-capability agents like regulated service providers (fiduciary-like responsibilities), and build layered defense-in-depth: preventive guardrails + monitoring + economic punishment.

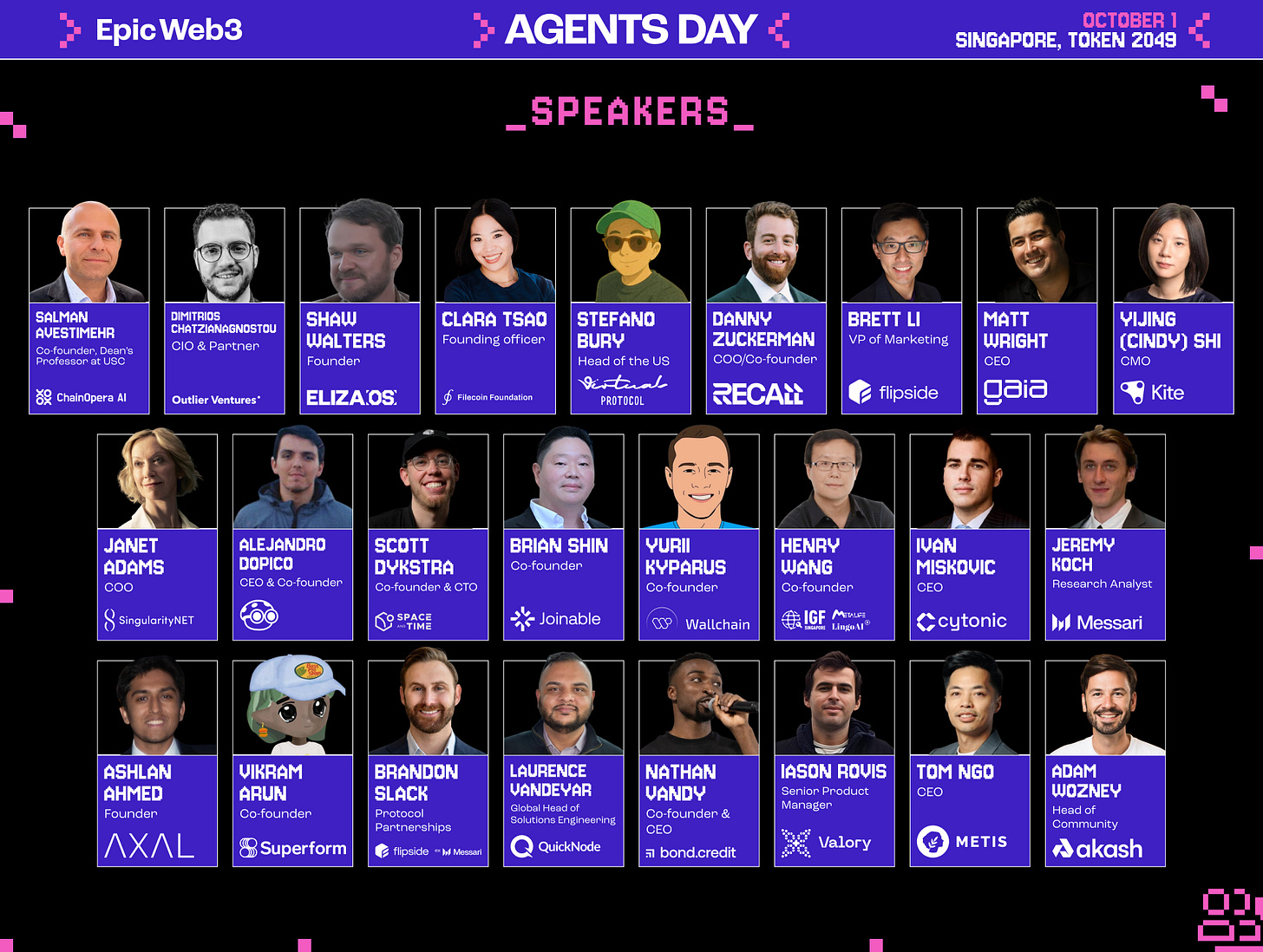

Agents Day lands in Singapore this Wednesday

✨ 25 speakers from leading Web3 + AI teams & rising stars: SingularityNET, Kite AI, Filecoin Foundation, Virtuals, elizaOS, Fungi, Axal & more

🎙 7 keynotes + 3 panels shaping the future of AI + Crypto from 09:30 to 17:00

🤝 450+ attendees: L1/L2 protocols, liquidity funds, VCs, agents, and top builders

🎫 High-quality networking

🍽 Food & drinks all day

Agents Day is where AI meets crypto to unlock autonomous systems without gatekeepers.

🎟 FREE to attend, but capacity is limited & filling fast!

Specialization, swarms, and task horizons

Capability growth is uneven across task types:

Specialized agents (narrow domain) extend what agents can do reliably — moving from minute-scale tasks into multi-minute or hour-scale workflows.

Swarms of specialized agents cooperating are preferable to single universal agents; they provide redundancy and composability.

Expect a two-tier adoption path: power users and protocols adopt first (top-down), then broader user bases as UX and trust mature.

Design implication: build small, verifiable agents that can be composed into swarms rather than betting on large, single agents.

Watch the full panel here:

That wraps it up for today! But before you go...

Check out our Twitter for more details. Follow us to stay updated on all the latest news!

Best,

Epic AI team.